An asset's total risk = systematic risk + unsystematic risk

....Systematic risk (market risk/undiversifiable risk) is the portion of an asset's risk that cannot be eliminated even using diversification. Its refer as Beta

.....Unsystematic risk (firm-specific/diversifiable risk) is the portion of an asset's total risk that can be eliminated via diversified portfolio.

BETA ASSET AND BETA PORTFOLIO

Beta (β) of a stock or portfolio refer to the degree of tendency on return or risk as compared to return/risk of the financial market as a whole.

IF; Beta asset or portfolio = 0; returns/risks of the asset or portfolio change independently

of changes in the market's returns/risk.

Beta asset or portfolio POSITIVE = The asset's/portfolios' returns/risks generally follow

the market's returns.

Beta asset or portfolio NEGATIVE = The asset's/portfolios' returns/risk generally move

opposite the market's returns/risk.

Assume that,

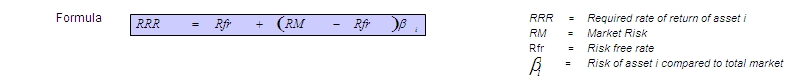

By using CAPM; the ERR(RRR) for stock Sykt. 1, Sykt.2 and Sykt.3 are:-

Sykt. 1: ERR(RRR) = 5% + (10%-5%)0.85 = 9.25%

Sykt. 2: ERR(RRR) = 5% + (10%-5%)0.7 = 8.50%

Sykt. 3: ERR(RRR) = 5% + (10%-5%)1.5 = 12.50%

Beta Portfolio = sumWiBi

= 0.2(0.85) + 0.4(0.7) + 0.4(1.5) = 1.05

(which means, the portfolio returnd/risks generally follow the market returns/risks)

Refer to P4122 Learning Kit Tool for further explaination on CAPM; Supposed students should know how to plot SML and make decision on the acceptance and rejected area.

Thank you.

No comments:

Post a Comment