Investment :

"Investment is the commitment of money or capital to the purchase/buy any financial instruments or assets to gain profitable returns in the form of interest, dividend income , or appreciation (capital gains) of the value of the instrument in the future."

Speculation is differ from gambling, as speculators do make an informed decision (based on analysis) before take any position. Additionally, speculation cannot be categorized as a traditional investment because the acquired risk is higher than average.

Money Market:A segment of the financial market with high liquidity and very short maturities are traded (with a maturity of one year or less and often 30 days or less). Money market securities consist of negotiable certificates of deposit (CDs), bankers acceptances, U.S. Treasury bills, commercial paper, municipal notes, federal funds and repurchase agreements (repos).

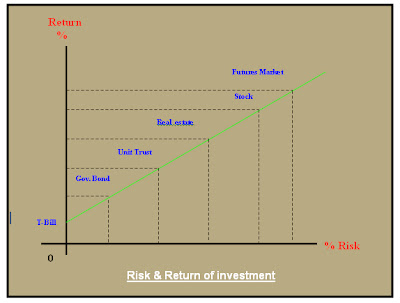

Normally, the investment risk is slightly lower compared to Capital Market, therefor, the return for this market also lower than the return offered by Capital Market.

Capital Market: refers to investment in long term financial intruments such as shares/stocks and bonds market. Since this instruments have long term maturity period so the risk of this investment is likely higher compared to Money Market instruments. As to compensate with the higher risk, the higher return often been offered to attract potential investors to put their money in Capital Market.

No comments:

Post a Comment