Sunday, January 23, 2011

MUST READ: MORAL ISSUE :Cry Over Spilt Milk

Dear P4122 students,

I believed many of you have ever heard the phase 'Never Bite The Hand That Feeds You.' Meaning to say, we must give our full respect to person who help us and made who we are today. They could be our parents, siblings, immidiate family as well as our teachers and lecturers since they sacrifice a lot for us.

Dear students, one way of showing our respect to them is by never CHEAT them... as for lecturers, they would feel very dissapointed and insulted to find that their students cheat during exams, tests or quizes. Cheating is generally considered as unethical, express laziness and serious misconduct among students. It's a form of dishonesty and likely comparable to stealing and lying.

As for me I can not tolerate with this matter since the exams, tests or quizes are very important tools to measure my students' performance. The result of those test will lead me to the broad picture of our teaching and learning progress. Finally, the results will be used to improve any part of our learning process.

Dear students, there is no easy way for success, as life never promise straight path for success. One needs to work hard and of course commited in what ever they do. Cheating brings you no good at all, and much more than that, you must be prepared to accept the consequences of cheating. It's a big risk, and if you get caught, take full responsibility for your actions. Nothing to proud of even if you get straight A's from cheating (since, you don't DESERVE it at all). You may pass your exams, but forever you will be shamed of yourself for your dishonest.

People who like to cheat mostly end-up with lose their self-confident (and forsure, people do not trust them anymore) and will carry this bad attitude in their daily life. Even, to some extend will keep on continue cheating in their future carreer. Just think about the impact of it. So, no matter what ever reasons you have in your mind, never cheat, do the best you can instead of mess arround. The most important thing is always be honest since...HONEST IS THE BEST POLICY.

STUDY HARD AND SMART...NEVER CHEAT. &. don't Cry Over Spilt Milk.

p/s: Spread the message to your friends.

TQVM

Sincerely yours.

P4122 Lecturer.

Tuesday, January 18, 2011

Monday, January 17, 2011

IMPORTANT ANNOUNCEMENT FOR GROUP ASSIGNMENT 1

Dear students,

1. All groups need to present the assignment using MS Power Point. The hardcopy must be submit 3 days before presentation (16th Feb 2011). The date of presentationyet to be decided is on Saturday 19 Feb 2011...as a replacement class-4 hours.

2. Group No. 3: Plot Bar Chart & Candle Stick Chart for MUDAJAYA & QSR

....guys you need to get/find theprince price info about both stocks start by today 16th Jan 2011 until 20 February 2011 16 Feb 2010. Just log on to Bursa Malaysia web site to collect the info.

3. Any problems regarding to assignment, please come and see me for futher clarification. Don't do it at last minutes.

4. All the related references must be properly quoted and attached with your report. Students are encourage to get the info from books or articles.

TQVM.

1. All groups need to present the assignment using MS Power Point. The hardcopy must be submit 3 days before presentation (16th Feb 2011). The date of presentation

2. Group No. 3: Plot Bar Chart & Candle Stick Chart for MUDAJAYA & QSR

....guys you need to get/find the

3. Any problems regarding to assignment, please come and see me for futher clarification. Don't do it at last minutes.

4. All the related references must be properly quoted and attached with your report. Students are encourage to get the info from books or articles.

TQVM.

Thursday, January 6, 2011

LECTURER NOTE : CAPITAL ASSET PRICING MODEL

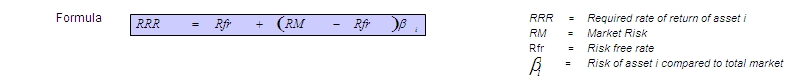

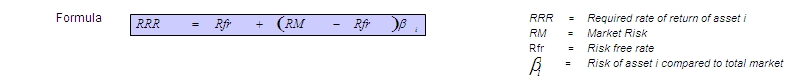

CAPM...one of the popular investment theory to compute the rate of return (Required Rate of Return, but sometimes also refer to Expected Rate of Return). Hence, the minimum requirement to invest is when RRR=ERR or ERR=RRR.

CAPM derived from RRR=RFR + (RM-RFR)Beta i

where: RRR = Required Rate of Return

RFR = Risk Free Rate ...e.g instrument like Treasury Bill

RM = Market Risk or Market Return

(RM-RFR) = Risk Premium

Beta i = degree of tendency in risk or return of asset i as compared to the market

Assume, Stock CMC has beta 0.5, risk free rate is 10%, the market risk 12%, so the required rate of return for Stock CMC = 10% + (12% - 10%)0.5 =11%.

Let say, if the Expected Return for CMC is 8%, the investor should not buy the stock since it is over-valued.

As a conclution, the CAPM is designed to help investor to derive their required rate of return before make any investment decisions. Always remember that, the best situation to invest is when ERR is bigger than RRR or at least ERR equal to RRR.

Key Words: ERR > RRR Under-value GOOD

ERR = RRR Fair-value GOOD

ERR < RRR Over-value NOT GOOD

The same CAPM theory also apply to portfolio, in this case the formula is;

RRRp = RFR + (RM - RFR) Beta portfolio

where; Beta portfolio = sum of Wi X Bi ; Wi = weighted allocation for asset i, Bi = Beta asset i.

Assume that, you have a portfolio consist of two assets, Stock A and Stock B, the information shown bellow.

Weighted Beta asset

Stock A 0.3 1

Stock B 0.7 0.5

Therefor, Beta portfolio = (0.3)(1) + (0.7)(0.5) = 0.65

if, risk free rate is 12% and market risk at 16%, the RRR for your portfolio will be 14.6%.

[RRRp = 12% + (16% -12%)0.65 = 14.6%]

EXERCISE;

1. Find RRR and make the decision for Stock A, Stock B, Stock C and Sock D based on the information given

bellow.

ASSET BETA ERR

Stock A 0.5 10%

Stock B 0.7 12%

Stock C 1.2 20%

Stock D 1.0 15%

the required rate of return is 10% and market risk is 14%.

2. Now you are about to form a portfolio based on information in question 1. The weighted ratio for each asset is 0.2:0.2:0.4 and 0.2. Find the RRRportfolio.

End of lesson...TQVM see ya again.

CAPM derived from RRR=RFR + (RM-RFR)Beta i

where: RRR = Required Rate of Return

RFR = Risk Free Rate ...e.g instrument like Treasury Bill

RM = Market Risk or Market Return

(RM-RFR) = Risk Premium

Beta i = degree of tendency in risk or return of asset i as compared to the market

Assume, Stock CMC has beta 0.5, risk free rate is 10%, the market risk 12%, so the required rate of return for Stock CMC = 10% + (12% - 10%)0.5 =11%.

Let say, if the Expected Return for CMC is 8%, the investor should not buy the stock since it is over-valued.

As a conclution, the CAPM is designed to help investor to derive their required rate of return before make any investment decisions. Always remember that, the best situation to invest is when ERR is bigger than RRR or at least ERR equal to RRR.

Key Words: ERR > RRR Under-value GOOD

ERR = RRR Fair-value GOOD

ERR < RRR Over-value NOT GOOD

The same CAPM theory also apply to portfolio, in this case the formula is;

RRRp = RFR + (RM - RFR) Beta portfolio

where; Beta portfolio = sum of Wi X Bi ; Wi = weighted allocation for asset i, Bi = Beta asset i.

Assume that, you have a portfolio consist of two assets, Stock A and Stock B, the information shown bellow.

Weighted Beta asset

Stock A 0.3 1

Stock B 0.7 0.5

Therefor, Beta portfolio = (0.3)(1) + (0.7)(0.5) = 0.65

if, risk free rate is 12% and market risk at 16%, the RRR for your portfolio will be 14.6%.

[RRRp = 12% + (16% -12%)0.65 = 14.6%]

EXERCISE;

1. Find RRR and make the decision for Stock A, Stock B, Stock C and Sock D based on the information given

bellow.

ASSET BETA ERR

Stock A 0.5 10%

Stock B 0.7 12%

Stock C 1.2 20%

Stock D 1.0 15%

the required rate of return is 10% and market risk is 14%.

2. Now you are about to form a portfolio based on information in question 1. The weighted ratio for each asset is 0.2:0.2:0.4 and 0.2. Find the RRRportfolio.

End of lesson...TQVM see ya again.

Tuesday, January 4, 2011

ASSIGNMENT 2: RISK & RETURN

Instruction: Print out the questions and attach with your answers. Please answer with your own handwriting.

Submit on Tuesday, 11 Jan 2011.

Part A:

Question: true / false.

1. The government may seek funding through the issuance of Treasury bills,Treasury bonds, including shares to finance development expenditure.

2. Investment refers to ownership of financial and physical assets.

3. The true speculator is not interested in financial assets that are purchased but they have a profit making motive in their mind.

4. Commercial paper is a medium-term debt notes which serve as collateral on a loan as to avoid a direct loan from the bank.

5. Business and government sectors are the main customers of the financial system.

6. Investors are encouraged to invest in cyclical industries during the economic downturn.

7. The option entitles the holder to buy or sell assets at determined prices during or before maturity.

8. The contribution on financial assets are not much helped as compared to physical assets in developing a country's economy.

Part B:

Essay:

1. Describe the relationship that exists between the physical assets and financial assets. In your opinion which of the assets to give better returns?

2. In your opinion, why individuals should make the investment, whether in physical assets or financial assets?

3. Define the investment. Why does every individual and organization should give serious consideration in decision making on investment? Discuss.

4. Speculation is one of the branches of the investment. Explain why investors are not encouraged to engage in speculative activities. Differenciate between Money and Capital Markets.

5. State four (4) of Money Market instruments, and two (2) of Capital Market instruments.

6. Derivatives Market is among the fastest growing market in Malaysia, and elaborate on the market along with the instruments in it.

7. A company that wants to raise and require additional capital funds can have several alternative ways to increase their capital. Please describe the methods or financial instruments that can be adopted for the long-term financing. A financial instrument is most suitable for a long term financing? Give your reasons.

TQVM.

Submit on Tuesday, 11 Jan 2011.

Part A:

Question: true / false.

1. The government may seek funding through the issuance of Treasury bills,Treasury bonds, including shares to finance development expenditure.

2. Investment refers to ownership of financial and physical assets.

3. The true speculator is not interested in financial assets that are purchased but they have a profit making motive in their mind.

4. Commercial paper is a medium-term debt notes which serve as collateral on a loan as to avoid a direct loan from the bank.

5. Business and government sectors are the main customers of the financial system.

6. Investors are encouraged to invest in cyclical industries during the economic downturn.

7. The option entitles the holder to buy or sell assets at determined prices during or before maturity.

8. The contribution on financial assets are not much helped as compared to physical assets in developing a country's economy.

Part B:

Essay:

1. Describe the relationship that exists between the physical assets and financial assets. In your opinion which of the assets to give better returns?

2. In your opinion, why individuals should make the investment, whether in physical assets or financial assets?

3. Define the investment. Why does every individual and organization should give serious consideration in decision making on investment? Discuss.

4. Speculation is one of the branches of the investment. Explain why investors are not encouraged to engage in speculative activities. Differenciate between Money and Capital Markets.

5. State four (4) of Money Market instruments, and two (2) of Capital Market instruments.

6. Derivatives Market is among the fastest growing market in Malaysia, and elaborate on the market along with the instruments in it.

7. A company that wants to raise and require additional capital funds can have several alternative ways to increase their capital. Please describe the methods or financial instruments that can be adopted for the long-term financing. A financial instrument is most suitable for a long term financing? Give your reasons.

TQVM.

Sunday, January 2, 2011

CHAPTER 2: PART III: CAPITAL ASSET PRICING MODEL

The Capital Asset Pricing Model (CAPM) relates the expected return on an asset to its systematic risk. The relationship is known as the Security Market Line (SML). The measure of systematic risk in the CAPM is refered to Beta.

An asset's total risk = systematic risk + unsystematic risk

....Systematic risk (market risk/undiversifiable risk) is the portion of an asset's risk that cannot be eliminated even using diversification. Its refer as Beta

.....Unsystematic risk (firm-specific/diversifiable risk) is the portion of an asset's total risk that can be eliminated via diversified portfolio.

BETA ASSET AND BETA PORTFOLIO

Beta (β) of a stock or portfolio refer to the degree of tendency on return or risk as compared to return/risk of the financial market as a whole.

IF; Beta asset or portfolio = 0; returns/risks of the asset or portfolio change independently

of changes in the market's returns/risk.

Beta asset or portfolio POSITIVE = The asset's/portfolios' returns/risks generally follow

the market's returns.

Beta asset or portfolio NEGATIVE = The asset's/portfolios' returns/risk generally move

opposite the market's returns/risk.

Assume that,

By using CAPM; the ERR(RRR) for stock Sykt. 1, Sykt.2 and Sykt.3 are:-

Sykt. 1: ERR(RRR) = 5% + (10%-5%)0.85 = 9.25%

Sykt. 2: ERR(RRR) = 5% + (10%-5%)0.7 = 8.50%

Sykt. 3: ERR(RRR) = 5% + (10%-5%)1.5 = 12.50%

Beta Portfolio = sumWiBi

= 0.2(0.85) + 0.4(0.7) + 0.4(1.5) = 1.05

(which means, the portfolio returnd/risks generally follow the market returns/risks)

Refer to P4122 Learning Kit Tool for further explaination on CAPM; Supposed students should know how to plot SML and make decision on the acceptance and rejected area.

An asset's total risk = systematic risk + unsystematic risk

....Systematic risk (market risk/undiversifiable risk) is the portion of an asset's risk that cannot be eliminated even using diversification. Its refer as Beta

.....Unsystematic risk (firm-specific/diversifiable risk) is the portion of an asset's total risk that can be eliminated via diversified portfolio.

BETA ASSET AND BETA PORTFOLIO

Beta (β) of a stock or portfolio refer to the degree of tendency on return or risk as compared to return/risk of the financial market as a whole.

IF; Beta asset or portfolio = 0; returns/risks of the asset or portfolio change independently

of changes in the market's returns/risk.

Beta asset or portfolio POSITIVE = The asset's/portfolios' returns/risks generally follow

the market's returns.

Beta asset or portfolio NEGATIVE = The asset's/portfolios' returns/risk generally move

opposite the market's returns/risk.

Assume that,

By using CAPM; the ERR(RRR) for stock Sykt. 1, Sykt.2 and Sykt.3 are:-

Sykt. 1: ERR(RRR) = 5% + (10%-5%)0.85 = 9.25%

Sykt. 2: ERR(RRR) = 5% + (10%-5%)0.7 = 8.50%

Sykt. 3: ERR(RRR) = 5% + (10%-5%)1.5 = 12.50%

Beta Portfolio = sumWiBi

= 0.2(0.85) + 0.4(0.7) + 0.4(1.5) = 1.05

(which means, the portfolio returnd/risks generally follow the market returns/risks)

Refer to P4122 Learning Kit Tool for further explaination on CAPM; Supposed students should know how to plot SML and make decision on the acceptance and rejected area.

Thank you.

Subscribe to:

Comments (Atom)